by Renee Wynter | May 17, 2024 | Blog, Finance

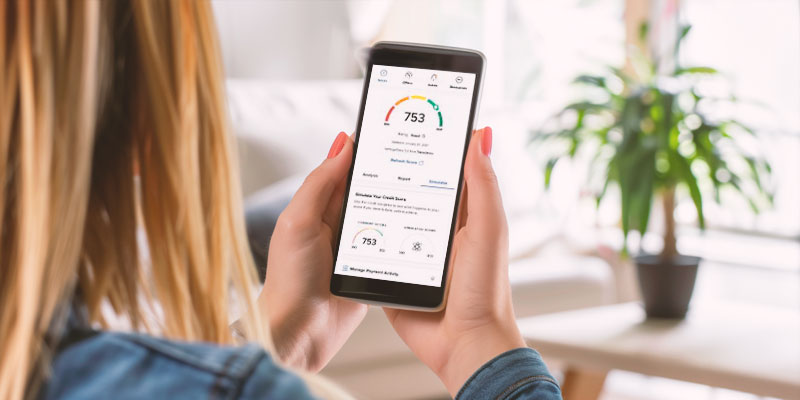

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

by Renee Wynter | May 3, 2024 | Blog, Finance

Real estate has proven to be a sound long-term investment. If you’re thinking about buying an investment property, consulting with your trusted mortgage agent is a terrific place to start. Your agent can play a crucial role by providing valuable expertise throughout...

by Renee Wynter | Dec 17, 2023 | Blog, Finance, Guest Post

Whether you’re becoming a homeowner for the first time or purchasing another property, this is an exciting time. But it also requires some work on your end in order to ensure the mortgage process runs as smoothly as possible. While it may appear as though you have to...

by Renee Wynter | Dec 1, 2023 | Blog, Finance

In the spirit of the holidays, it’s easy to get caught up with the excitement of festive decorations, gift-giving, entertaining and gatherings with loved ones. But it’s important to stay on budget so you start 2024 off without financial regrets. Following are some...

by Renee Wynter | Nov 17, 2023 | Blog, Finance

Your financial well-being is at the core of our mission as mortgage agents and brokers. And Financial Literacy Month is a great opportunity for you toNovember is Financial Literacy Month!get empowered and ensure you always make informed decisions regarding your...

by Renee Wynter | Jul 7, 2023 | Blog, Finance, Homeownership

Looking to buy your first home? Saving up for your down payment can seem virtually impossible unless you have a plan in place. Fortunately, there are more savings options available today than ever before. There are three main savings accounts you can use to your...