If you’re getting tired of all the media headlines claiming impending housing market and economic doom and gloom, you’re not alone. It seems every time you browse the news another US economist is predicting terrible things for Canada. Articles like this one, claiming an ‘extreme bubble’ is just around the corner… note, not just a bubble… but an extreme bubble.

The truth is, mortgage rates have never been lower and while low interest rates are somewhat blamed for increased house prices, low interest rates are good for borrowers who are looking to get into the market. So despite what the media would have us believe, now (historically speaking) is actually a pretty good time to buy a property.

Understanding that you can’t control the future, and of course past performance doesn’t indicate future direction, if you isolate the actual cost of borrowing money, you might be surprised at how cheap money is right now. Obviously buying a property is a personal decision, the time has to be right for you, and your finances have to be in order, but if the sensational media headlines are causing you to second guess yourself or the market, let’s have a look at the cost of borrowing today compared to previous years.

Fixed Interest Rates

Fixed interest rates are at an all time low. Seriously, it has never been cheaper to borrow fixed money in Canada. Here is a handy chart that provides a visual to that effect, showcasing the historical posted 5 year mortgage rates from 1973 to today.

Reference: Bank of Canada Interest Rates

Here are a couple points to note:

- In July of 1981, fixed rates were at 21.75%.

- 21.75% is a higher rate of interest than a lot of credit cards. Yikes!

- In July of 2016, rates were at 4.74%.

- 4.74% is a posted rate, a lot of broker channel lenders have discounted rates in the low 2% range.

Prime Rate

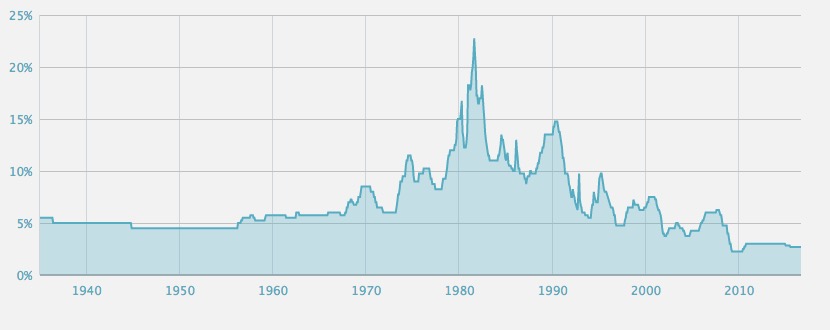

So, fixed rates are a little too permanent for you? No problems, the prime rate (the rate that sets the baseline for a variable rate mortgage) can be found hovering below half of the Canadian historical average. So here is another handy chart that provides a visual going back to 1935 up until today.

Reference: Bank of Canada Interest Rates

A couple points to note:

- The 80s were not only bad for music and fashion, but a bad time to borrow money as well.

- Although prime is 2.7%, lenders offer a variable component discount as well tied to the prime.

- Discounts in today’s lending landscape are around half a percentage point.

- The 40s, 50s, and 60s, were pretty steady, who knows, we might just be in for some more of that!

Let’s Talk

So regardless if you prefer the fixed or variable, as you can see, it’s never been cheaper to borrow money. Period. Please don’t let the media scare you into thinking the market is about to implode, their job is to sell advertising not bring a balanced perspective to your newsfeed. Affordability is a personal thing and shouldn’t be dictated by a market you can’t control.

If you would like to figure out what you can afford, and go over your financial situation to prepare for getting a mortgage, I’d love to help. Please contact me anytime, I would love to work with you.